Once upon a time firearm enthusiasts legally hijacked tax money from federal bean-counters. You pay excise tax throughout the year with every cartridge and firearm purchase, and the Pittman-Robertson story is so familiar a copy is on your nightstand to handle insomnia. There’s more to the story, though.

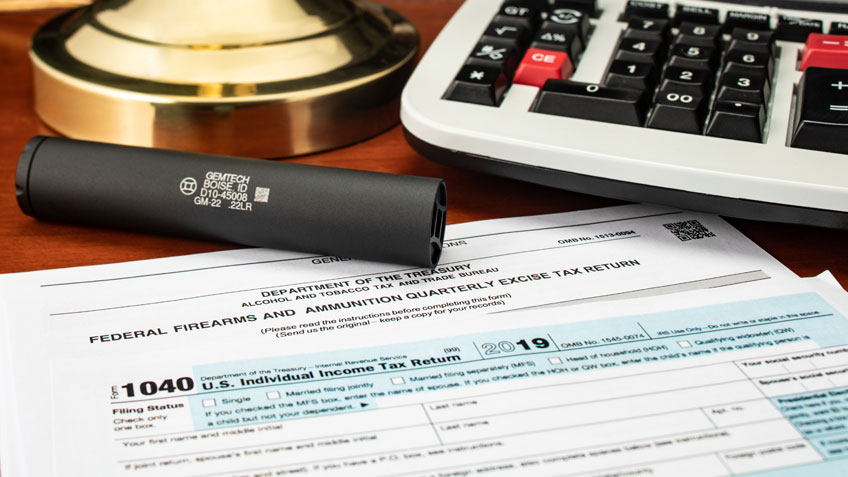

Your dog-eared version likely ignores the Revenue Act of 1918, signed into law by then-President Woodrow Wilson on Feb. 24, 1919. It levied the first excise tax on firearms, part of a tardy effort to recover the cost of World War I. The better-recognized National Firearms Act (NFA) of 1934 followed.

The Great Depression came and went, and the government continued collecting the 11-percent firearm and ammunition excise tax. Funds went into a general budget black hole until Carl Shoemaker—yet another name likely omitted from your bedtime version—came up with a scheme. The Oregon publisher and former Ohio attorney crafted language and began circulating it to legislators.

Sen. Key Pittman (D-NV) and Rep. Absalom Willis Robertson (D-VA), sponsored the legislation and the Federal Aid in Wildlife Restoration Act became law in 1937. Now money raised through that excise tax went to the Secretary of the Interior, who in turn distributed it to states for wildlife conservation work, education, a range or two and other projects.

In 1970, the Dingell-Hart Bill directed funds raised on a 10-percent excise tax on handguns to the Pittman-Robertson fund. In 1972, the Goodling-Moss Act added an 11-percent levy on archery equipment, with the money added to the coffers.

Since 1937, a total of $18.8 billion (in current dollar value) has been generated for wildlife conservation, habitat, ranges and education. Unfairly, wildlife conservation has reaped the lion’s share of the benefits, with ranges and education receiving a far smaller share of the revenue.

That changed last year when President Donald Trump signed the Target Practice and Marksmanship Training Support Act into law. It’s a dramatic improvement in the ability for each state to use the funds to establish and improve public shooting ranges—and the effects will be felt nationwide.